IRS details summer tax return filing deadline for Texas, extension requests

Published 10:53 am Tuesday, June 8, 2021

|

Getting your Trinity Audio player ready...

|

AUSTIN — The Internal Revenue Service is reminding Texas taxpayers the deadline to file their 2020 federal income tax return is June 15, 2021.

Earlier this year the IRS announced that victims of the February winter storms in Texas have until June 15, 2021, to file various individual and business 2020 tax returns and make tax payments without penalties and interest, regardless of the amount owed.

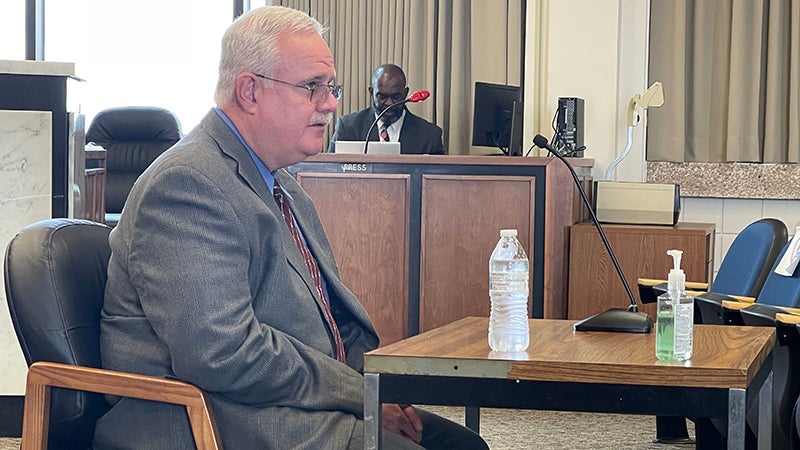

“Individual taxpayers who need additional time to file beyond the June 15, 2021 deadline can request an extension until Oct. 15,” said IRS spokesman Michael Devine.

“The IRS can’t process extension requests filed electronically after May 17, 2021 so they need to print and mail Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.”

Businesses that need additional time to file income tax returns must file Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.

An extension gives taxpayers until Oct. 15 to file but does not grant an extension of time to pay taxes due.

The IRS automatically identifies taxpayers located in the covered disaster area and applies filing and payment relief. But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at 866-562-5227 to request this tax relief.

For more information about deadlines to file a 2020 federal income tax return, see IR-2021-122, IRS reminds taxpayers living and working abroad of June 15 deadline or visit the official IRS website, IRS.gov.