STRENGTH: Small Business Development Center ready to guide through tough times

Published 12:17 am Saturday, April 25, 2020

|

Getting your Trinity Audio player ready...

|

(Editor’s note: This is one of a series of stories published this weekend in Part 4 “STRENGTH” of The Port Arthur News’ 2020 Vision For Success series. The series appears each weekend in April and can also be read at panews.com.)

The Small Business Development Center exists to strengthen local economies through supporting small businesses.

Today, these centers at Lamar University in Beaumont and Lamar State College Port Arthur are doing what they can to keep businesses afloat during the COVID-19 shutdown.

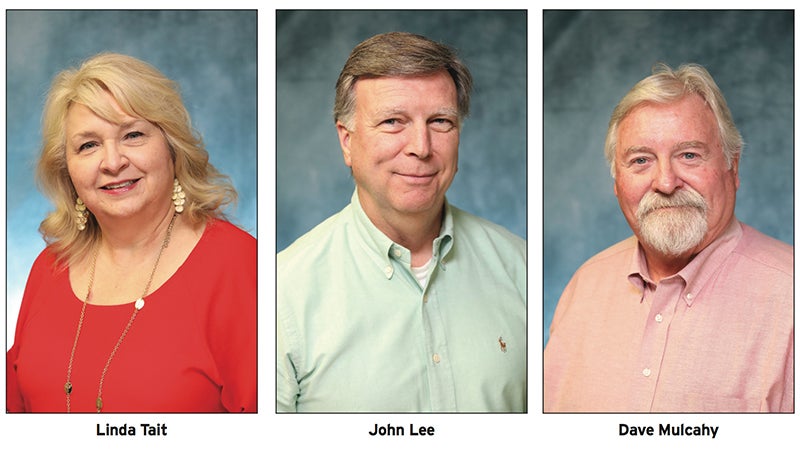

David Mulcahy at the Lamar University SBDC said his group is providing as much guidance as they can to help businesses weather the economic downturn. He has been especially focused on directing information about the Economic Injury Disaster Loan Program and the Paycheck Protection Program to any business that qualifies.

“A lot of information that’s coming out here for these loans is being manipulated by word-of-mouth, and it’s not necessarily a good idea for that to happen,” Mulcahy said.

“We try to give you the truth about what you’re eligible for and kind of guide you down that path. We have information out there for the payroll protection plan that everybody’s eligible, whether they’re a sole proprietor, whether they’re a 1099 or an independent contractor. We have all that information and we transfer that out.”

Lamar University SBDC business advisor John Lee said business owners and operators need to know these programs are available and the SBDC is also available to help them navigate the application process.

They are also there to clear up any confusion as to what the programs do.

“With the (Economic Injury Disaster Loan), somehow the word was getting out on TV stations that it had a $10,000 advance,” Lee said. “The advance is up to $10,000, according to how many employees you have and what you actually needed, but still did not need to be repaid.

“We told them about the terms of the loan, how it worked, what the paperwork was that they needed, and then what it was for. That loan could be used to pay for almost any expenses you have. There were no real restrictions on them. Since it was set up as a 30-year note at 3.75 percent, it has very good terms, including the fact that you didn’t have to make a payment for 12 months.”

Linda Tait, director of the SBDC at Lamar State, said more businesses, especially those of people who are self-employed, need to know that they can apply for the Paycheck Protection Program.

For many of these businesses, they simply need to ask for help, and the SBDC is there to help them.

“They need to know to at least ask the questions,” Tait said. “They’re not going to find out anything if they sit back and wait for someone to come to them. A lot of businesses will call me and say they think they don’t qualify for the PPP loans because they don’t have payroll. They do qualify if they’re a sole-owned business because their profits are considered payroll for themselves. They don’t think they can apply for economic injury for the same reason — they don’t have employees — and these are the businesses that aren’t asking for assistance. They’re suffering through it and just not asking for help. They just need to start asking for help.”

Even nonprofits could qualify, Lee said.

“We don’t normally work with non-profits, but in this situation we were reaching out to the ones we knew of to try to get the word out and make sure they were able to take advantage of that, because a lot of them, being closed down, had absolutely no revenue coming in,” he said.

On one topic in particular, Tait, Lee and Mulcahy all agreed: Businesses are going to have to adapt to the current circumstances.

“This is a time for your company to morph,” Mulcahy said. “You’re going to have to do something different in the future to draw attention to yourself, to draw business in the front door.”

Lee has seen many businesses like restaurants pivot toward curbside pickup and delivery that’s allowing them to stay open.

“Some of these restaurants are being very successful with their deliveries, their drive-thrus and their takeout services, but they have to market that,” he said. “They have to change. I’m sure there are some dishes that just don’t work for takeout, and so they’re going to have to have a reduced menu, but they can still get the food out there.”

Tait has seen the same thing, and such adaptations may mean the difference between being able to stay open in the long run.

“So may retailers out here are doing a phenomenal job of selling online, going on to Facebook live and modeling blouses, pants, dresses and purses, selling them and having curbside pickup,” she said. “A lot of people tell me they’re just going to give up until all of this is over with, but they may not have a business to come back to if that’s the way they’re looking at it. They need to think of other ways of doing business.”

Once the normal business climate does return, Mulcahy said the SBDC can help businesses use the pandemic to help find weaknesses and better practices.

“There’s a lot of people that have been in business who thought there was something wrong with their company but couldn’t put their finger on it,” he said. “This pandemic has actually brought some of those issues to light. We can actually help them ferret out what those issues were and maybe be a guidepost on how to solve those problems. We can point them out, and hopefully they’ll listen.”